Decoding Polter Finance’s $12M Hack

Uncover the $12M Polter Finance hack! Learn how an oracle manipulation attack and flash loans exploited vulnerabilities. Security lessons for Web3 projects.

What Just Happened?

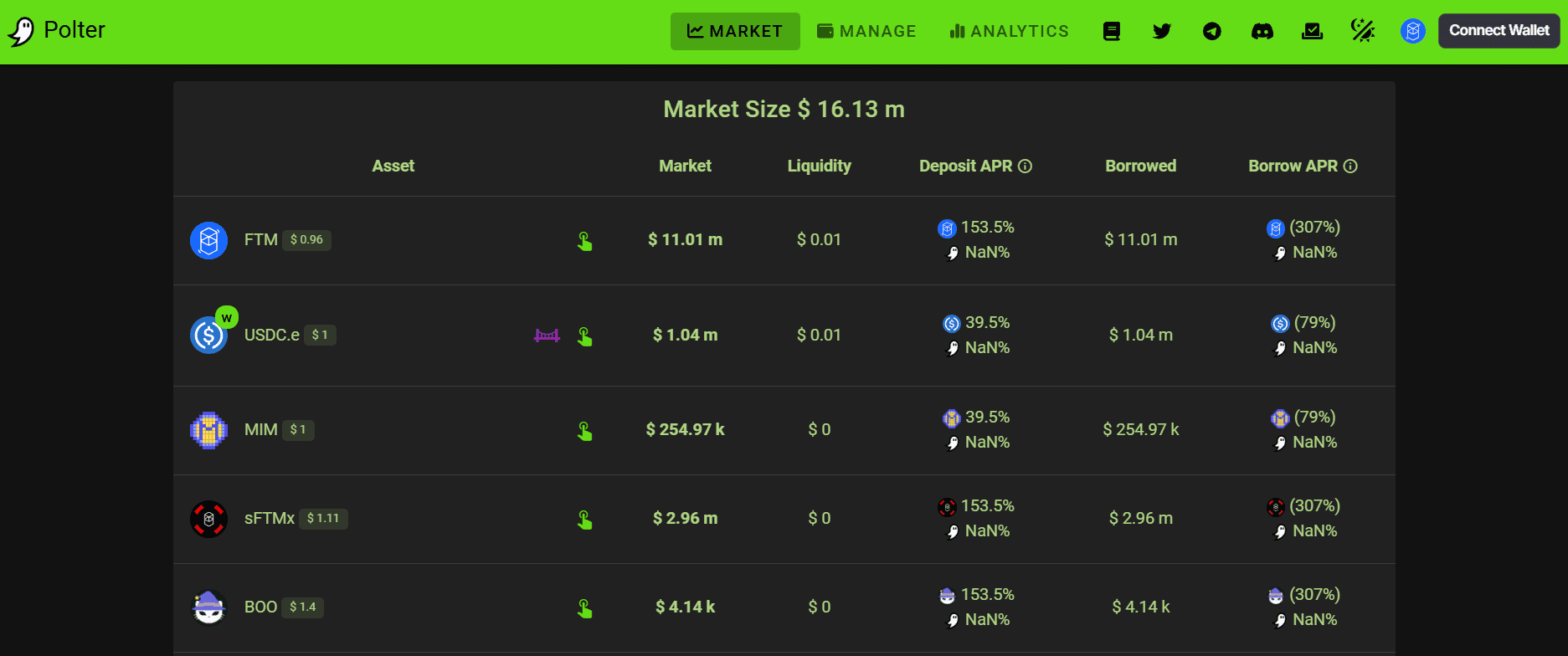

Polter Finance, a Fantom (Rebranded to Sonic) based decentralized lending and borrowing platform, suffered a devastating $12M hack.

The culprit? A classic oracle manipulation attack, where the hacker artificially inflated the price of the $BOO token (a governance token from SpookySwap), using it to drain Polter’s liquidity pools via a flash loan.

Too Long; Didn't Read (TL;DR)

- Polter Finance exploited for $12M due to an oracle manipulation attack.

- $BOO token price was manipulated, enabling the hacker to drain liquidity pools.

- Flash loans were used to execute the attack.

- Root cause: Lack of robust security measures and reliance on a vulnerable oracle setup.

What Was Polter Finance’s Purpose?

Polter Finance was a decentralized, non-custodial lending and borrowing platform on the Fantom chain. It allowed users to deposit assets to earn interest and borrow against their holdings. The platform was created to meet the community's demand for a service similar to the discontinued $GEIST protocol, adopting the same smart contract structure. However, this approach not only carried over its functionality but also its underlying vulnerabilities.

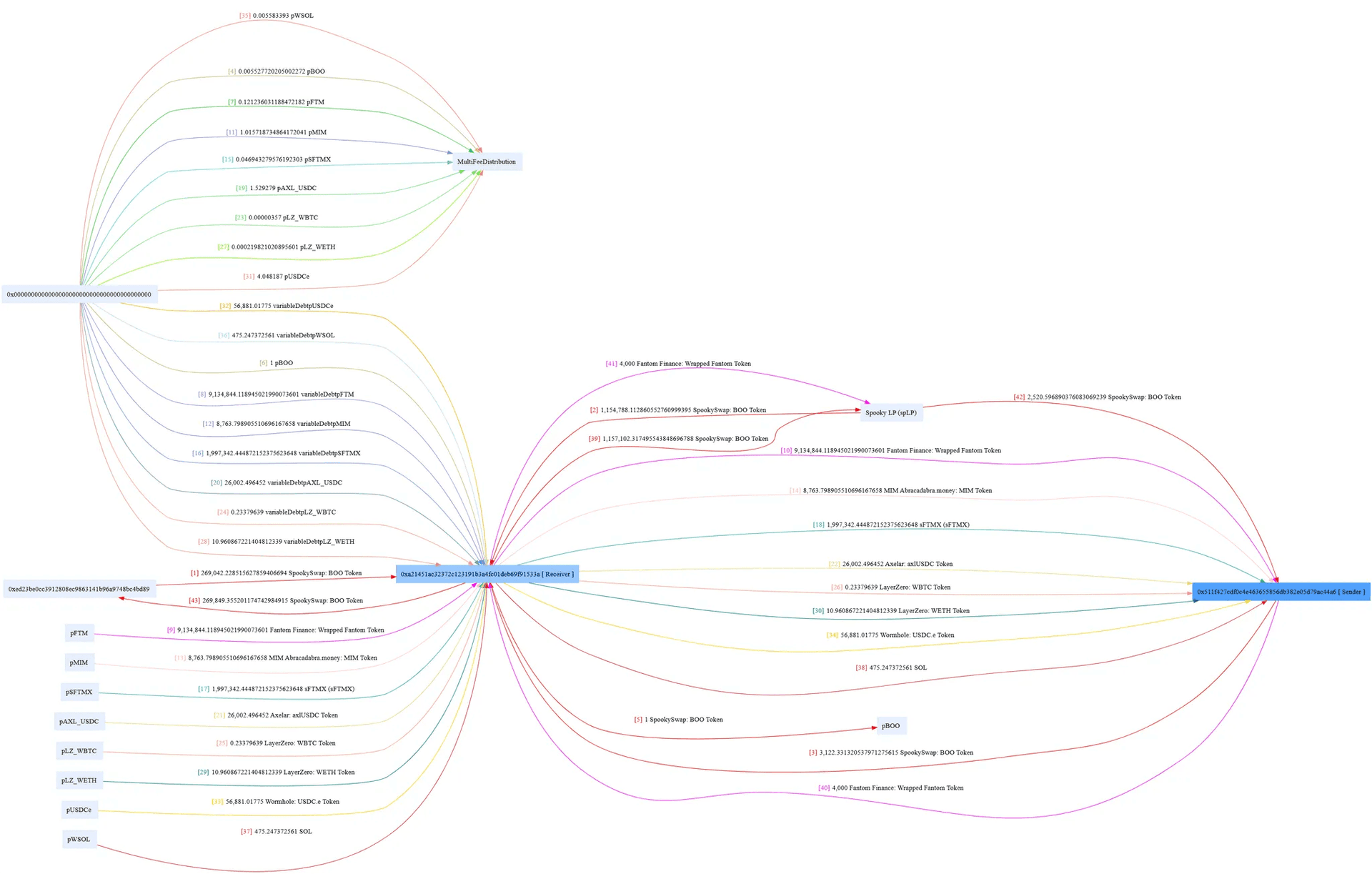

How Did the Attack Go Down?

Step 1: Flash Loan Setup

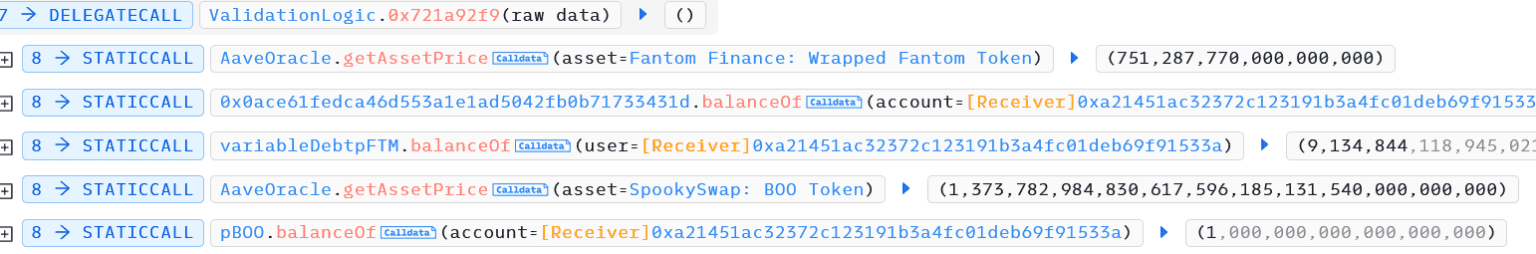

The attacker initiated the exploit by borrowing nearly all $BOO tokens from the SpookySwap LP using a flash loan.

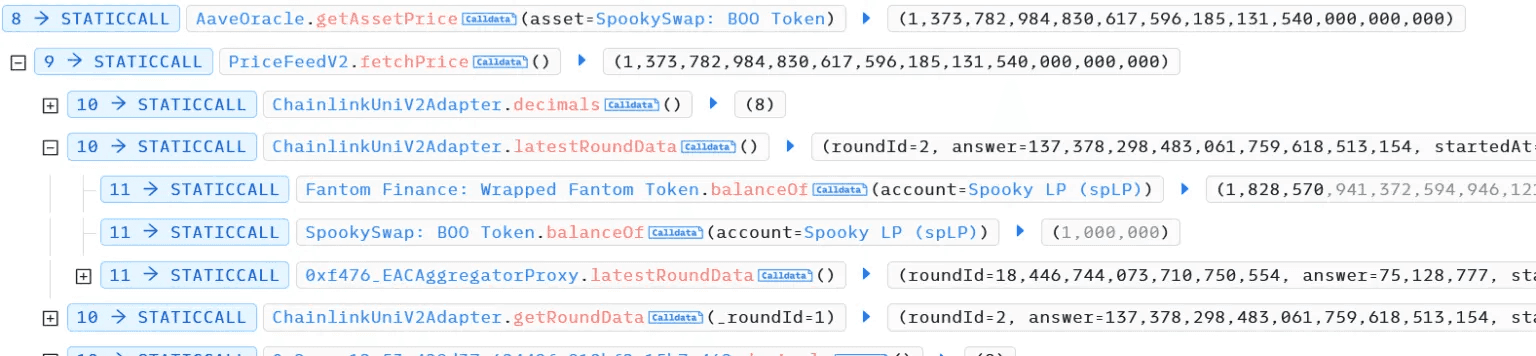

Step 2: Oracle Manipulation

By draining the LP, the attacker artificially increased the price of the $BOO token. This manipulated price was picked up by Polter’s oracle.

Step 3: Draining Polter's Liquidity

The inflated $BOO token was deposited into Polter Finance, allowing the hacker to drain all its liquidity pools.

Step 4: Exit Stage Left

The attacker walked away with $12M in stolen assets & siphoned the funds away via Tornado cash, leaving Polter Finance and its users high and dry.

What was the Root Cause?

The root cause of the hack was due to price manipulation facilitated by oracles.

The price of the SpookySwap BOO token in the lending pool was determined by the spot price from the SpookySwap v3 pool and v2 pair; calculated based on the token balance ratio in the pool.

The attacker borrowed nearly all the available BOO tokens from the LP, which resulted in an artificially high BOO price.

This allowed the attacker to deposit just 1 BOO and drain all pools. This is a textbook example of why forked projects must undergo thorough security audits.

Where Did the Funds Go?

The stolen funds were moved to wallet address 0x39Fde96298720A689b0C95BfD3a69F38b85032D9, as identified on the blockchain.

Polter Finance reached out to the hacker via an on-chain message to negotiate the return of funds, but there has been no response.

Attack transaction: https://app.blocksec.com/explorer/tx/fantom/0x5118df23e81603a64c7676dd6b6e4f76a57e4267e67507d34b0b26dd9ee10eac

Could This Have Been Prevented?

Absolutely. Here’s how:

- Audits from Experts: A comprehensive audit from a trusted security partner like QuillAudits could have identified and mitigated these vulnerabilities before launch.

- Flash Loan Mitigation: Disabling flash loans, as Polter plans to do post-incident, should have been implemented from the start.

- Robust Oracle Systems: Integrating a reliable and manipulation-resistant oracle would have prevented price inflation exploits.

What’s the Takeaway?

Neglecting security is a recipe for disaster. Forked projects like Polter often assume the original developers’ security measures are enough - but as this attack shows, cutting corners costs millions.

The Web3 ecosystem desperately needs projects to prioritize user safety. Audits aren’t optional, they’re essential. Polter’s $12M loss is a harsh reminder that without proper precautions, trust and assets can vanish overnight.

Why QuillAudits?

Choosing a reputable audit firm like QuillAudits ensures that your protocol undergoes rigorous scrutiny from experienced security professionals. Our smart contract security audit services specialize in uncovering critical vulnerabilities and providing actionable remediation strategies. Our expertise helps safeguard your project from attacks, ensuring that security issues are addressed proactively.

Contents